Don't Listen to the Doom Merchants

There’s plenty of opportunity in streaming, and even in Pay TV, with the right UX

As news headlines suggest Pay TV and OTT services are in crisis, Media Distillery’s Head of Product, Martin Prins looks at the trends that are shaping this narrative and reveals why there’s still reason for video services of all kinds to be optimistic.

“Pay TV is doomed!” We’ve heard that message from the media’s fear-mongers for years. The likes of Netflix and Disney+ have typically been presented as the new-tech giant-killers that will see off the dinosaurs of linear TV and bundled broadcast content. More recently, FAST is put forward in similar terms as the big streaming services face their own issues with churn and financial losses.

Perhaps that’s true in the USA, but here in Europe, the "doomed" Pay TV operators may actually be in a better position than they were three to five years ago when compared to the ambitions of content owners with their own D2C app. Yes, they’re facing unprecedented headwinds, but they’ve also got a fantastic new toolbox of solutions to deploy to tackle those challenges. That’s why markets like France are seeing growth in Pay TV, and operators like DT are seeing growth in TV subscriber numbers.

So, what’s driving the doom-centric messaging? And how can video services win the fight for viewer attention?

Key trends in the fight for viewer attention

After several years of so-called streaming wars, the big OTT SVOD services are no longer in the driving seat. To protect revenue in a challenging market, they’ve all begun pivoting to hybrid business models with ad-funded options and hiked prices for those who don’t want ads. At the same time, they’re cracking down on rampant password sharing.

Against this landscape, it’s little surprise that we’re seeing increasing aggregation (is any of it really “super”?), re-licensing and re-bundling of OTT content. Yes, after a decade of talk about OTT enabling consumers to turn their back on “all-in-one” contracts, it’s now increasingly common for operators to include “rival” streaming services like Netflix, Max, Paramount or Apple TV+ in their pay TV packages. A great example is the Freebox Ultra package in France, where for €49,95 per month subscribers get access to 8GB fibre, 280 TV Channels, plus access to Canal+, Disney+, Netflix, Prime Video. Which is really a great deal.

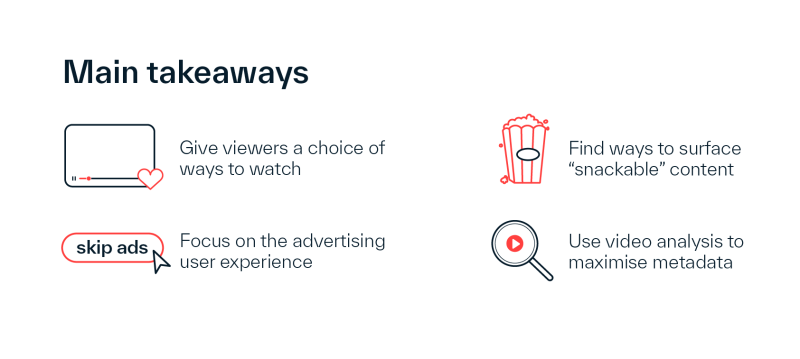

The key takeaway here: it’s all about an appealing offer to consumers, but also making sure to have a great user experience. To survive and thrive, operators need to give consumers an easy life, and crucially a choice of ways to view. Both of these will have a positive impact on NPS and subscriber churn.

There are two areas here where we at Media Distillery think operators are missing a trick: Advertising and Content Discovery.

Making advertising work for everyone

Let’s be honest, nobody loves watching adverts, but it’s a necessary evil for most viewers who’d rather watch the ads than pay. Video streaming services of all kinds need to find a way to integrate advertising that doesn’t create any more frustration for customers than is absolutely necessary.

One way to do this is to offer a premium service where users can skip ads. That’s a pretty simple thing to do if you’re Netflix or Disney and working on a VOD-only OTT service, but it’s much harder for Pay TV operators offering a linear-to-VOD replay service. Take, for example, the award-winning Replay Comfort Ad-Free Pay-TV service from our friends at Swisscom. Powered by Ad Break Distillery’s AI video analysis to accurately identify the start and ends of ad breaks in linear programming, this service enables viewers to choose whether they’re willing to watch ads or not.

The same technology can also be used to enable choice in other ways. Want to repurpose your linear TV content as AVOD or for use in a FAST channel? You’re going to need to know where the ad breaks fall. Conversely, if you want to repurpose SVOD-native content for AVOD or FAST, you’ll need to identify suitable locations for ad breaks where previously there were none. And if you’re going to make viewers watch adverts, let’s at least make them relevant! Replace outdated adverts with ones for current offers, make them contextual to the content the viewer has chosen to watch, and make them shoppable.

These steps will all help enhance the user experience as well as optimising revenue for the operator. But each of them requires an increasingly detailed understanding of when the ad-breaks fall, and what’s featured in the surrounding content. Once again, AI analysis of the video can provide the context to drive relevance.

As choice grows, great content discovery makes choosing easy

Having said that we need to give consumers choice in the WAY they watch, we also need to help them deal with too much choice over WHAT they watch. As the range of channels (both linear and FAST) grows, so too does the volume of catch-up content. Add to that AVOD and SVOD libraries and you’ve got a giant search and discovery nightmare. An increasing number of today’s consumers are used to a TikTok-style content discovery experience where clips are short and you’re presented with the content you’re interested in as if by magic thanks to their algorithms. Viewers may keep turning to Pay TV for live sports and long-form content, but if operators can’t also present them with the short-form content they love, they’ll be off to rivals like YouTube and TikTok faster than you can say “snackable content”.

So what is to be done? Today, too many video services still have terrible search functionality that’s based on basic keywords and frequently returns zero results. But intelligent search and recommendation algorithms, which both make it truly easy for viewers to find your content, require understanding of content: detailed, fine-grained and descriptive metadata. Highlighting the content segments that are normally buried behind bland EPG descriptions, especially for live, unscripted content will help to power topic-based searches and populate thematic carousels. Here in the Netherlands, NLZIET has been doing this to great effect with our Topic Distillery solution. We see the positive impact on content discovery and playback, helping viewers have a better overview of content with chapters and chapter titles and quickly jump to the parts they’d like to see, and thus increasing engagement.

What about Generative AI?

2023 was the year when it seemed everyone in the world woke up to the concept of Generative AI and its potential in a vast range of use cases. 2024 is the year when companies have to show the real benefits of this technology. We’ve been working with GenAI tools for a number of years so we’re already able to see the huge impact it can have on content discovery.

Our Topic Distillery solution mentioned above uses GenAI to generate a synopsis and chapter titles for the live and unscripted content of customers like NLZIET. When you combine it with Large Language Models (LLMs) for user query interpretation and our semantic search capabilities, things start to get really interesting. So, where previously a search for “Max Verstappen” might have returned only one program result that featured his name in the 150-character EPG description, now we can easily surface every piece of content where the Formula 1 driver is even mentioned: from post-race interviews and news clips to a round-table discussion about the last race on a late-night sports show. Matching this AI-generated metadata to Media Distillery’s accurate time markers and surfacing them via API to the operator’s user interface means viewers can quickly jump to the parts of the show that are most relevant to them.

By using a variety of (AI-based) content analysis modules, we make sure viewers can discover more and more relevant results. We’re returning content based on what we see inside it, which is more detailed and more relevant than just recommending content based on the EPG descriptions, which typically lack detail on live programming.

In a recent pilot with a large operator, we saw that this led to a huge boost in content discovery. Viewers indicated that they’d found relevant content they didn’t know was on the platform, often in channels and on programs they weren’t normally viewing.

This application of Generative AI is particularly successful when you’re working with really large collections of content, such as a Pay TV operator’s bundle of many TV channels that expand the library by hundreds of hours of new shows every day, and are now augmented by content from the likes of Netflix and Disney+, offering a lot of value to the consumer with a user experience that was not possible before.

Want to know more?

If you’d like to know more about how to Navigate the AI Hype in the Media Industry, Download our e-guide. And if you’d like a demonstration of how these technologies and trends can be implemented in your business, book a meeting with our experts.

March 26, 2024